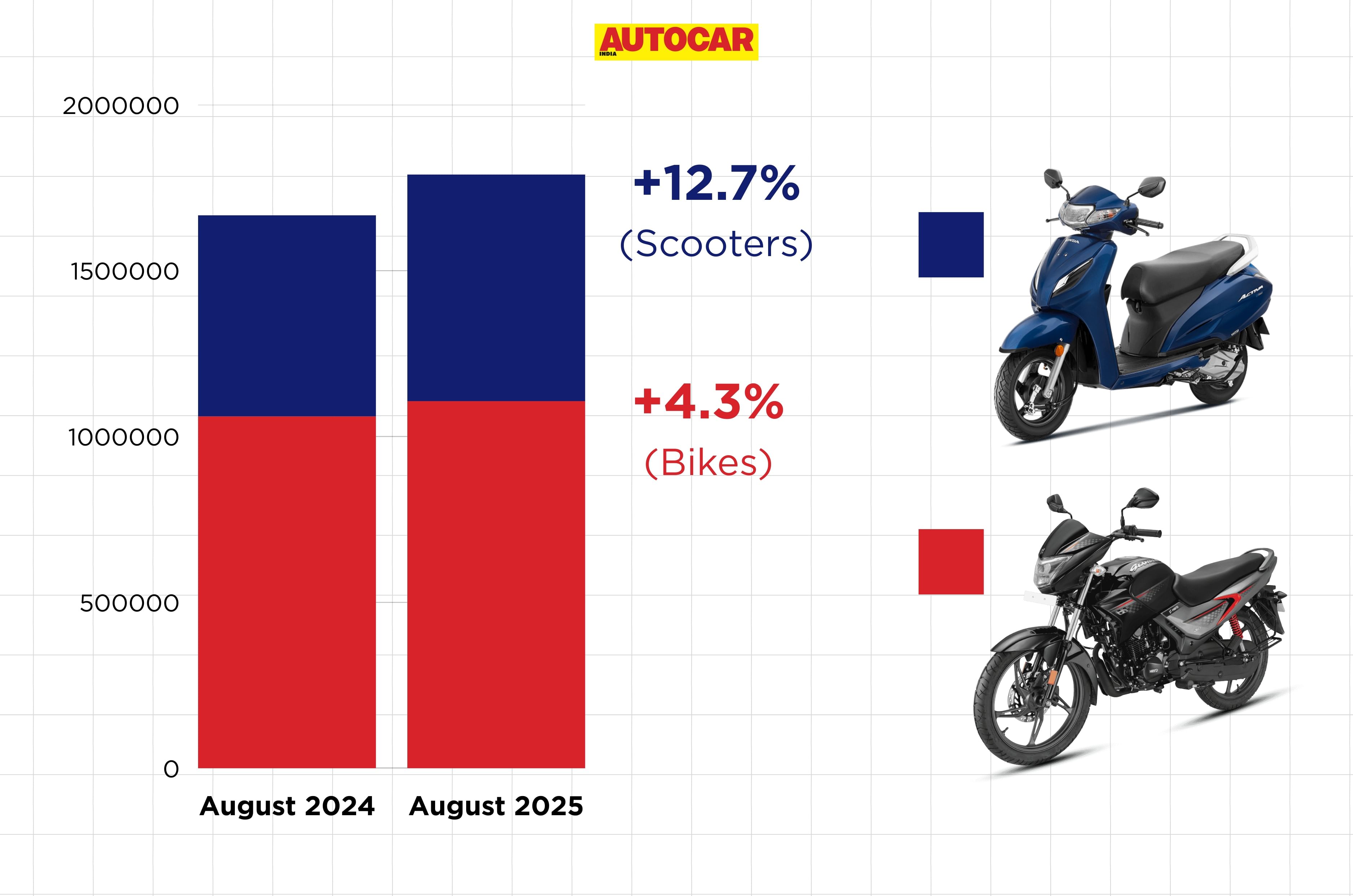

Why scooter sales have grown 3 times compared to bikes in August 2025

According to SIAM (Society of Indian Automotive Manufacturers), as of August 2025, scooter sales grew 12.7 percent. That is three times faster than the growth of bike sales at 4.5 percent.

Leve Anthony arrived at a TVS showroom in Andheri in Mumbai to buy a TVS Raider for his brother. Later, the college student walked out of a Suzuki showroom, booking an Access instead. “Looking at Indian road conditions and practicality to carry stuff, I decided to go for a scooter,” he said.

What is driving this sudden shift? Let's know from customers and numbers alike.

Practical Accessibility

Aditya Rikame says, "Mostly what drove me towards buying a scooter instead of a bike was more of the practicality. Once you have a kid, the practicality of the scooter becomes very important." Aditya Rikame traded his sporty Suzuki Gixxer to buy a TVS Jupiter to carry his son and have space to carry things at the same time.

Azhar Khan, a gym trainer from Mumbai, points out a reality: "Indians are usually short; most new bikes are tall. If young girls aren't able to sit comfortably, what about elder women?" proving the ability of scooters serving both genders.

Engineering student Om Jagdale explains family influence while purchasing: "You can't go against your parents. In some households, parents prefer scooters, as they think they are safer," Om observes. Another factor is price, as scooters are more affordable than bikes in general. Om ended up buying an Activa to not go against his family's wishes.

The gap between motorcycle and scooter sales has been narrowing. In August 2025, the difference was 4.23 lakh units, compared to a gap of 4.55 lakh units in August 2024. The data is more lopsided in the electric two-wheeler market. As of FY 2024, scooters made up roughly 95 percent of the overall electric two-wheelers sold.

The emergence of performance and electric scooters

The recent emergence of sporty and premium scooters has convinced more buyers.One of the first brands was Aprilia, which came out with its SR 150 scooter. However, this segment has been seeing motion in recent times, through Piaggio with its Vespa line of scooters and Yamaha with the Aerox 155. Recently, Hero came out with the Xoom 160, and TVS came out with the NTORQ 150.

Research firm Kearney predicts that scooter penetration could reach 40 percent by 2030, driven by "shifting urban preferences and a rising female workforce". For manufacturers, this shift represents both opportunity and challenge. Traditional motorcycle-focused companies are expanding their scooter portfolios, while scooter specialists are pushing into premium segments previously dominated by bikes.

from Autocar India https://ift.tt/60Yedmg

Comments

Post a Comment